Decentralized Finance or DeFi is a financial ecosystem that operates without the traditional centralized intermediaries including banks, brokers, or exchanges. DeFi is built predominantly on the Ethereum blockchain, although other blockchains also support DeFi applications. It aims to replicate and innovate traditional financial services like lending, borrowing, and trading without central authorities.

The Emergence & Rise of DeFi

The emergence of Decentralized Finance (DeFi) is a recent phenomenon in the financial world. It took the principles of blockchain and cryptocurrencies to create a decentralized financial system.

DeFi’s roots can be traced back to the creation of blockchain technology and the launch of Bitcoin in 2009. Blockchain introduced a decentralized ledger system that supports all DeFi applications. The launch of Ethereum in 2015 was a pivotal moment for DeFi. Ethereum’s platform allowed for the creation of smart contracts which are self-executing contracts with the terms of the agreement written into code. These smart contracts became the building blocks for DeFi applications.

Initial DeFi applications were simple including decentralized exchanges (DEXs) and lending platforms. These allowed users to trade cryptocurrencies and assets without relying on traditional financial intermediaries.

From around 2018 onwards, DeFi began to gain significant traction. Broader interest in cryptocurrencies and the realization of blockchain’s potential to revolutionize financial services fueled this growth.

DeFi experienced explosive growth during 2020-2021, with billions of dollars locked in DeFi contracts. This growth was driven by the broader crypto market boom and increased recognition of the potential advantages of DeFi over traditional finance.

How DeFi Works?

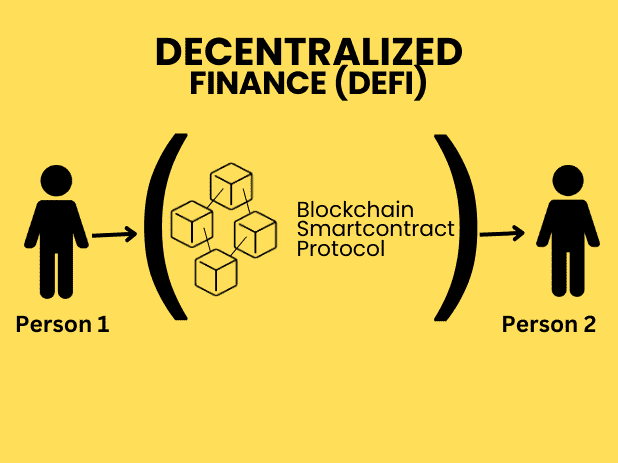

Decentralized Finance (DeFi) works by using blockchain technology, particularly smart contracts, to create financial services that operate independently of traditional financial and governmental institutions.

-

Blockchain Technology

DeFi is built on blockchain technology, a distributed ledger that records all transactions across a network of computers. This technology guarantees transparency, security, and immutability of financial transactions.

-

Smart Contracts

Smart contracts automatically execute and enforce the terms of a contract when predefined conditions are met. They enable DeFi services to function without intermediaries. For example, in DeFi lending, a smart contract automatically matches lenders with borrowers and sets the terms, interest rates, and duration.

-

DeFi Applications

Here are some DeFi applications:

- Decentralized Exchanges (DEXs) allow users to trade cryptocurrencies directly with each other without the need for a central authority.

- Lending platforms allow users to lend out their cryptocurrencies and earn interest, or borrow cryptocurrencies by providing collateral.

- In yield farming, users provide liquidity to a DeFi protocol (usually by depositing cryptocurrency) and earn rewards in return, often in the form of additional cryptocurrency.

- DeFi extends to products like decentralized insurance against smart contract failure and platforms for trading derivatives.

-

Use of Cryptocurrencies and Tokens

Cryptocurrencies and digital assets facilitate all transactions in DeFi. Additionally, many DeFi platforms issue their own tokens, which stakeholders can use for governance purposes, such as voting on platform changes, or as an investment in the platform.

-

Wallets and Accessibility

Users access DeFi services through digital wallets (like MetaMask, TrustWallet, etc.), which store their cryptocurrencies and interact with DeFi applications. Anyone with an internet connection and a digital wallet can access DeFi platforms, regardless of their location or the local financial infrastructure.

Advantages of DeFi

The following are the advantages of DeFi:

Increased Accessibility and Inclusivity

Decentralized Finance (DeFi) platforms are accessed by anyone with an internet connection and a digital wallet. This global accessibility breaks down geographical barriers inherent in traditional finance.

DeFi offers financial services to individuals who traditional banking systems underserve or exclude, especially in areas with underdeveloped financial infrastructure. These services typically don’t require credit checks which makes them accessible to a broader range of users.

Transparency and Security Features

Transactions in DeFi are recorded on a blockchain, an open ledger that anyone can view and verify. This transparency builds trust among users. The public nature of blockchain transactions allows for better auditability and accountability of financial activities.

The decentralized nature of blockchain reduces the risk of central points of failure including central servers or databases, which are common targets for hacks in traditional finance.

Reduction in Transaction Costs and Times

DeFi significantly reduces transaction fees by eliminating intermediaries (like banks and brokers). This is especially beneficial for cross-border transactions. The use of smart contracts automates many processes in financial transactions, further reducing costs and improving efficiency.

Blockchain technology enables quicker transaction processing times compared to traditional banking systems that take days for cross-border transactions.

Programmability and Flexibility of Financial Products

DeFi platforms are updated based on user feedback and market needs. This adaptability guarantees that financial products evolve much faster than their traditional counterparts.

Smart contracts allow for the creation of highly programmable and customizable financial products that cater to a wide array of needs and preferences.

The Future Outlook of DeFi in Banking

DeFi’s growth suggests significant potential impacts and emerging trends that could reshape the financial landscape.

Potential Impact on Traditional Banking Systems

DeFi presents a competitive challenge to traditional banks, pushing them towards innovation. Banks may need to adopt blockchain technologies or partner with DeFi platforms to stay relevant. They could lead to greater financial inclusion worldwide, particularly in underbanked or unbanked regions. These platforms indirectly push traditional banks to expand their services to these areas.

One of DeFi’s core propositions is the elimination of intermediaries. Financial services such as lending, borrowing, and trading could undergo a transformation as a result of this. Its growing presence will attract more regulatory attention. This could lead to new regulations that might reshape both DeFi and traditional banking practices.

Emerging Trends in DeFi

Here are some emerging trends in decentralized finance (DeFi):

-

Non-Fungible Tokens (NFTs)

NFTs have extended the scope of DeFi by tokenizing unique assets like art, real estate, or intellectual property. This opens up new avenues for investing, trading, and securing digital ownership rights.

-

Decentralized Autonomous Organizations (DAOs)

DAOs are gaining traction as a model for decentralized governance. They could revolutionize decision-making processes in financial services and allow more democratic and transparent operations.

-

Interoperability and Cross-Chain Technology

There is a growing trend towards creating interoperable DeFi systems that can communicate across different blockchain networks. This trend enhances liquidity and expands the market potential.

-

Layer 2 Solutions and Scalability

As DeFi grows, scalability becomes crucial. Developers are actively developing layer 2 solutions, such as rollups and sidechains, to handle more transactions at a lower cost without sacrificing security.

Final Words

DeFi represents a significant shift in the financial sector by offering an alternative to traditional banking services with a focus on decentralization, transparency, and accessibility. The integration of technology with finance has the potential to reshape financial services significantly.